.jpg?width=700&name=190605%20UnitedBenefits_2x1%20(49).jpg)

TSP Matching is the greatest advantage that FERS employees have when it comes to building their Thrift Savings Plans. Are you taking advantage of it?

1. HOW MUCH MONEY WILL THE AGENCY CONTRIBUTE TO MY THRIFT SAVINGS PLAN?

Depending on how much money you contribute into your Thrift Savings Plan, the agency will contribute to your TSP as well– however, not always dollar-for-dollar. It’s important to know the ratio, so you can figure out how to get the most bang for your buck.

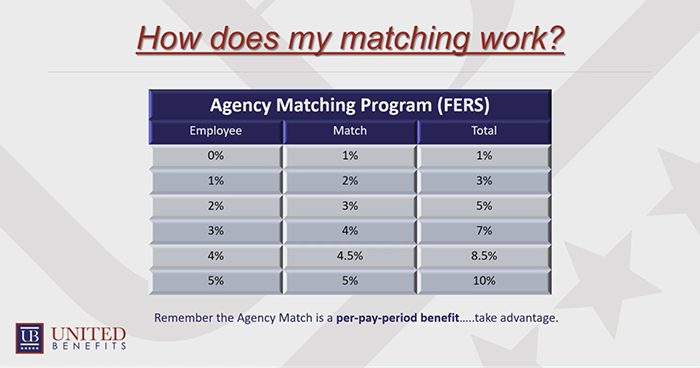

Below is an easy to follow chart that demonstrates what the agency will match based on how much you contribute to your TSP.

Even if you’re not putting in a dime, your agency will contribute 1% of your paycheck automatically.

If you contribute between 1-3% of your paycheck, the agency will match every dollar you contribute– and you’ll also get that extra 1% from them as well. That means if you’re putting 3% of your paycheck regularly into your TSP, the agency is putting in 4%. That’s a total of 7% going into your retirement funds!

If you select to contribute 4%, the agency will match the 4% dollar for dollar plus 50¢ equally 4.5%, and if you contribute 5% then they’ll match 5% dollar for dollar.

That means for the first 5% of your paycheck that you contribute, your TSP will actually receive 10%. You can effectively double your savings thanks to the matching program, if you take advantage of it!

2. HOW OFTEN SHOULD I CONTRIBUTE TO MY THRIFT SAVINGS PLAN?

It’s exceedingly important to remember that matching occurs per paycheck. You shouldn’t try to dump an extra portion of money into your TSP at the end of the year.

It’s better to give steady contributions, in order to receive steady matching amounts.

For example, if you give 5% of your $2,000 paycheck every two weeks, the agency will give 5% every two weeks. That means $200 is regularly going into your TSP on a bi-weekly basis, and at the end of the year your TSP will have gained $5,200. You contributed $2,600 and received a match of $2,600.

But on the other hand, if you skip contributing during any pay periods, that’s a matching opportunity that you won’t get back. You’ll only get the automatic 1% for each paycheck (in this case, that’s $20 every two weeks). If you were to forego contributing for most of the year, and then pour $2,000 into your TSP as a one-time contribution with your last paycheck, you’ll only get a 5% match on that paycheck, equal to $100. As a result, your TSP will have only gained $2,600 for the whole year.

3. HOW MUCH SHOULD I CONTRIBUTE TO MY THRIFT SAVINGS PLAN?

It’s best to start by contributing what you can. You should be aiming to eventually achieve that 5% match; but if you can’t do that instantly today, that’s alright. Work your way up to it.

If your goal is to only get the matching then set it by Percent and not by Dollar. That way, if you get raises or COLAs or step increases or promotions, your contribution amount and its matching will increase.

4. IS THERE A CONTRIBUTION LIMIT TO MY THRIFT SAVINGS PLAN?

There is a dollar limit in how much money you can contribute to your TSP per year, while still receiving the matching contributions from FERS.

As of 2019, federal employees can contribute up to $19,000. However, if you're older than 50, there's a catch-up provision that allows you to contribute up to $25,000. (Remember, that's your contributions, not the matching.)

That said, depending on how large your paycheck grows, you may need to be careful not to hit your limit early in the year. If you max out the contribution too early in the year, you will sacrifice the 5% matching opportunity for the remainder of the year. Anything over $19,000, before the year is up, will not receive the benefit of the agency matching 5%.

5. ARE TAXES TAKEN FROM THE AGENCY CONTRIBUTIONS TO MY THRIFT SAVINGS PLAN?

The money contributed by the agency to your Thrift Savings Plan will always go into the Traditional TSP, and not the Roth TSP. You yourself are free to choose which you’ll contribute to, but it’s good to understand differences between the Traditional and Roth TSP when making your decision.

Your Traditional TSP earnings (and therefore any matching contributions you receive) are made before taxes, and the interest is tax-deferred. Therefore, whatever money you eventually earn will be taxed upon withdrawal.

Whatever you do to save for retirement, please make sure to take advantage of the TSP Matching! Ignoring it is one of the number-one pitfalls that federal employees make.

Are you getting the maximum amount of matching with your current TSP contributions?

We can help you figure that out!

United Benefits has assisted thousands of federal employees on several impactful topics. We can help you, too. Ask us anything!

Click here to request a consultation and talk one-on-one with a representative about the options available to you. United Benefits and its representatives do not make specific trade recommendations for individual TSP funds.