The Civil Service Retirement System is a defined benefit contributory pension plan. It was established August 1st, 1920, and was later replaced by FERS in 1987.

If you became a federal worker before 1987, then more than likely calculating your retirement funds and eligibility will actually fall under CSRS, and not FERS. There are a couple exceptions to this.

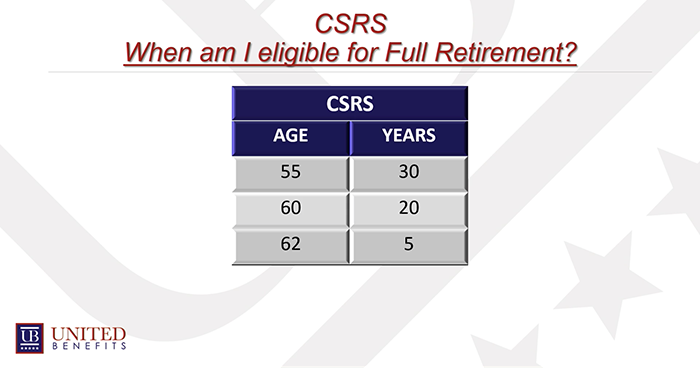

WHEN AM I ELIGIBLE FOR FULL RETIREMENT UNDER THE CIVIL SERVICE RETIREMENT SYSTEM?

Your eligibility for full retirement, or full benefits, under CSRS is determined by both your age and also your years of creditable service.

At age 55, you need to have 30 years of service. At age 60, you only need 20 years of creditable service. If you’re 62, you only need five years of service– remembering, of course, that your first year of service had to have started before 1987.

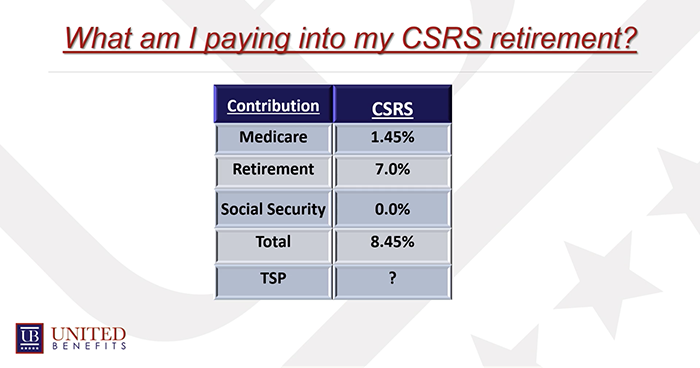

WHAT AM I PAYING INTO THE CIVIL SERVICE RETIREMENT SYSTEM?

Employees under CSRS have three possible deductions for retirement: Medicare, CSRS retirement, and TSP. Like employees under FERS, you pay 1.45% into Medicare, and your TSP depends entirely on what you contribute.

The CSRS differs from FERS in that employees do not pay into social security. Instead, they contribute a higher amount of 7% into their CSRS. This means a total of 8.45% of your pay is going towards your retirement, plus any additional amount you contribute to TSP.

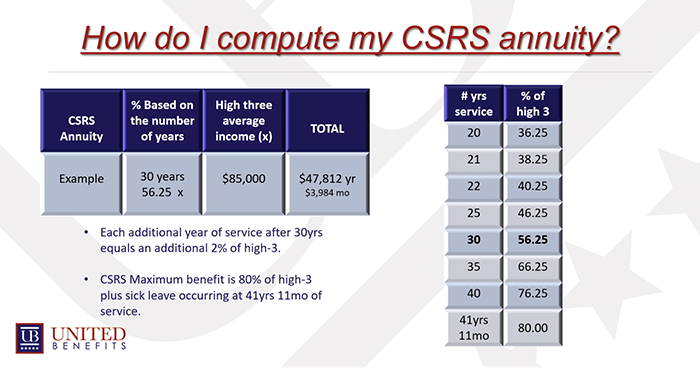

HOW DO I COMPUTE MY ANNUITY WITH THE CIVIL SERVICE RETIREMENT SYSTEM?

When computing your annuity under the Civil Service Retirement System, you will need to use your years of creditable service; your high-3 average income; and a certain percentage of that income, which is determined by your years of service (as seen in the chart below).

A worker under CSRS with 30 years of service should multiply their high-three salary (say, $85,000) with 56.25%, or .5625. In this case, the individual’s retirement pension would be approximately $47,812 per year– or $3,984 per month.

For every additional year above 30, you’ll add another 2%. However, if you’ve worked for 41 years and 11 months or more, the maximum percentage you can use in this equation is 80%.

Once you know what that percentage will be for you, just multiply it by your high-3 average income to determine your pension under the Civil Service Retirement System.

UNSURE ABOUT YOUR BENEFITS UNDER THE CIVIL SERVICE RETIREMENT SYSTEM?

United Benefits has assisted thousands of federal employees on several impactful topics. We can help you, too. Ask us anything!

Click here to request a consultation and talk one-on-one with a representative about the options available to you.