.jpg?width=700&name=190320%20UnitedBenefits_2x1%20(26).jpg)

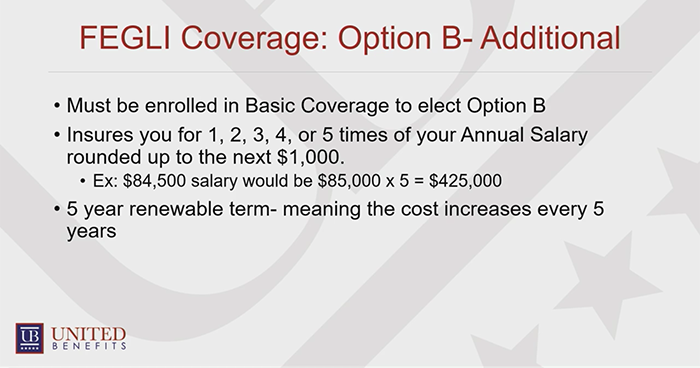

Eligible new employees are automatically enrolled in FEGLI Basic unless they waive the coverage. You may have enrolled in FEGLI Option B for your coverage. Like all the other options, you must have basic enrollment in order to be eligible for this plan.

FEGLI Option B is essentially term insurance – with a guaranteed renewable five year term.

This plan in particular can insure you for as much as 1, 2, 3, 4, or even 5 times your Annual Salary rounded up to the nearest $1,000.

AN EXAMPLE OF FEGLI OPTION B

Let’s say your annual salary is $84,500. You can be insured for $85,000…or up to $425,000.

Every five years, the cost for that coverage will increase.

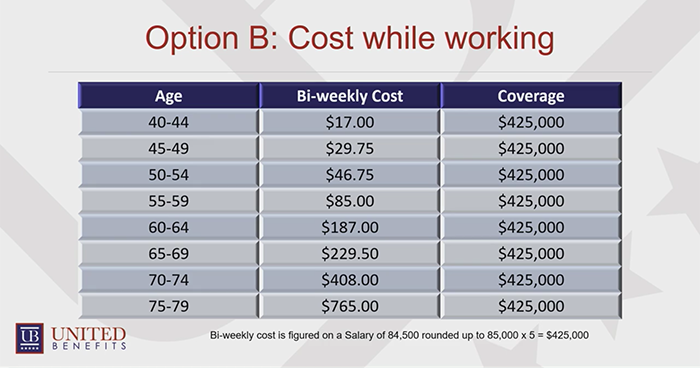

If your age ends in a zero or a five, that's when the cost goes up. It’s not that bad while you’re young, but as you age it gets very expensive. At age 40, the bi-weekly cost is only $17. But by age 55, it almost triples to $46.75. At age 60, it jumps up pretty significantly to $187 – and you’re still receiving the same amount of coverage the whole time!

Having Option B while you’re working is important for federal employees who might be supporting a family or paying off a mortgage on their home. Term insurance is there to cover you while you need it.

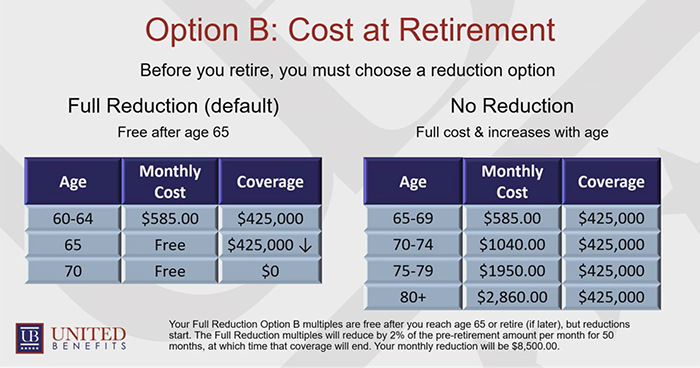

But what happens after you retire? If your FEGLI defaults to the free reduction plan, your coverage will drop– not by 75%, but by 100%. You will effectively lose your term insurance.

On the other hand, if you elect for no reduction plan because you want to maintain your full coverage post-retirement, the cost will still increase every five years until you’re 85. Using our current example, that would mean a monthly cost of $2,860 at age 80! That’s an arm and a leg!

A better option is to find a supplemental partner who knows how FEGLI works– and who can offer life insurance plans with coverage and rates that will actually be beneficial to you.

Don’t procrastinate when it comes to finding a better life insurance option. If you just take the initiative to act early, you can increase your present coverage, keep enough life insurance for your retirement, and save thousands of dollars over time.

How much could your term insurance cost you by the time you retire?

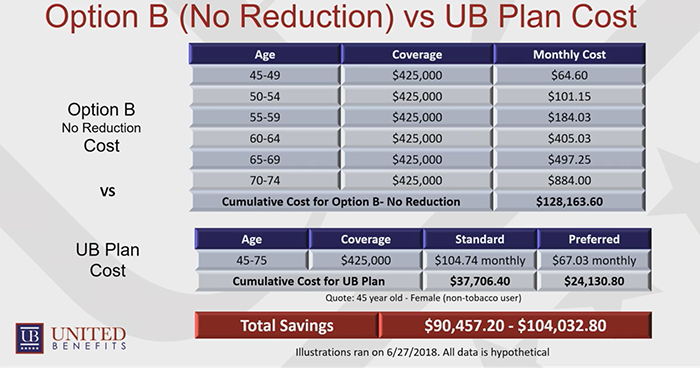

If you’re paying for FEGLI Option B because you need it, United Benefits can help you save a lot of money.

If you lock in a term policy with United Benefits under FEGLI Option B with no reduction, your monthly cost will be locked in and won’t change for 30 years. Over three decades, that could reduce the cumulative cost of your coverage by 81%!

The healthier you are, the lower your price will be. The key is to just start early. The sooner you do, the more you will save.

United Benefits has assisted thousands of federal employees on several impactful topics. We can help you, too. Ask us anything!

Click here to request a consultation and talk one-on-one with a representative about the options available to you.