DO YOU HAVE A WRITTEN BUDGET AND A PLAN!?

As a federal employee preparing for retirement, there are several things that you need to be concerned about. The key to making sure that everything goes smoothly is to have a budget and a plan. You wouldn’t go on a road trip or board a plane without knowing where you’re headed or preparing enough resources to make it there, right?

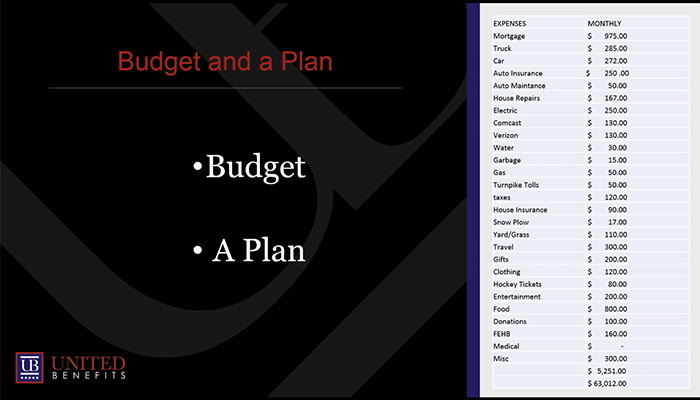

1. WRITE YOUR CURRENT RETIREMENT BUDGET DOWN ON PAPER

It’s kind of surprising how many people don’t think to do this. Many see expenses go out from their paycheck, but they’ve never sat down to add up all the numbers or calculate accumulation over time.

So make sure that, if you haven’t already, you take the time to put your budget and plan to paper to see if they’re really practical or as robust as you think.

It’s a good idea because it can help you snapshot what you’re actually spending during every pay-period, to see if anything can be eliminated and to know what you’re going to need to earn financially, both now and in the future after you retire.

2. MAKE A RETIREMENT PLAN TO ADDRESS POTENTIAL HURDLES

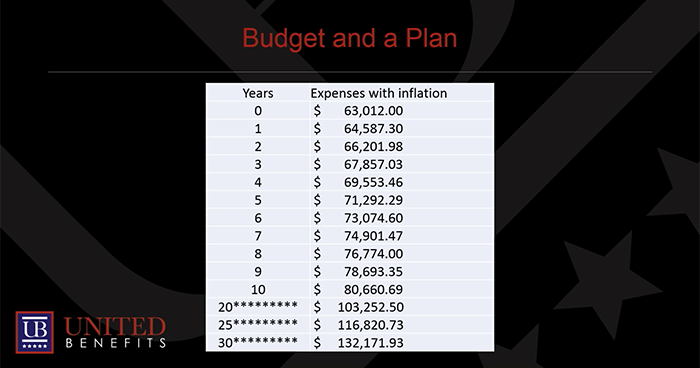

The next step is to try and make preparations or adaptations of your budget with factors of change in mind. Your expenses may change, of course, but inflation is a particularly major concern. The prices of goods and services have historically increased over time, and your retirement dollars now may not be able to buy as much in the future if the amount is not adapted accordingly.

As you can see in the chart above, $63,000 per year today will need to increase to $80,000 per year in a decade in order to have the same purchasing power; and that will need to increase all the way up to $132,000 per year in three decades.

Inflation has a major impact on your expenses. What you require as income on a monthly basis to be able to live comfortably throughout retirement will likely only increase as time goes by. Have you been preparing for that?

HAVE YOU TAKEN INFLATION AND OTHER FACTORS INTO ACCOUNT WHEN PLANNING FOR YOUR RETIREMENT?

Have you used a calculator to determine your budget for retirement or the cost and benefits of FEGLI over the course of your lifetime?

United Benefits has assisted thousands of federal employees on several impactful topics. We can help you, too. Ask us anything!

Click here to request a consultation and talk one-on-one with a representative about the options available to you.