When it comes to saving for retirement as a federal employee, one of the options at your disposal with the widest variety your TSP, or Thrift Savings Plan.

WHAT ARE THE FIVE PRIMARY GOALS OF TSP?

- Income Replacement

- Protection of Principal

- Growth Potential

- Accessibility to Funds

- Beneficiary Protection

After you retire and no longer receive traditional paychecks, you will use TSP as one of your main sources of income. One of the suggestions we make at United Benefits is to follow the “70% Rule.” This means you should be able to afford retirement once you can replace approximately 70% of your income. This is a practice that the National Retirement Institute recommends as well.

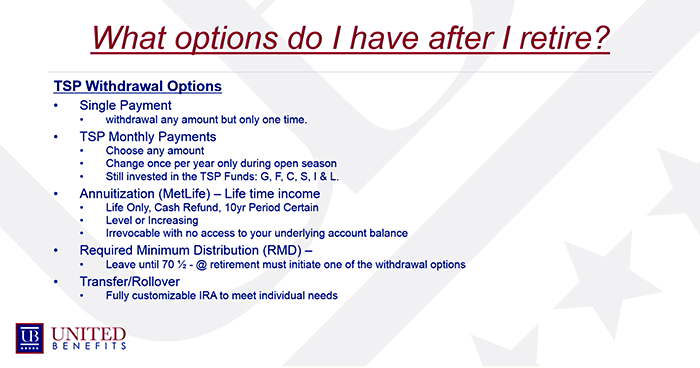

WHAT TSP PAYMENT OPTIONS DO YOU HAVE AFTER YOU RETIRE?

- Four Payment Option (formerly the Single Payment Option)

- Monthly Payments (now includes Annual or Quarterly Payments)

- Annuitization (MetLife) – Lifetime Income

- Required Minimum Distribution (RMD)

- Transfer (Also known as Rollover)

FOUR PAYMENTS (FORMERLY SINGLE PAYMENT) OPTION

In the past, the single payment option meant you could withdraw any amount from the TSP that you desired. However, you could only do so one time (hence the name “single” payment). After that, your next withdrawal would have to take out all the remaining TSP funds at once.

Fortunately, now that the TSP Modernization Act of 2017 has been enacted, you can actually withdraw amounts of your choice from TSP up to three times before you must finally withdraw the remaining balance.

MONTHLY PAYMENT OPTION

If you set up monthly payments, you can arrange for any amount out of your TSP to be paid to you monthly. This option used to be somewhat limited because you could not change that amount more than once per year– and even then, you could only do so once during “open season.”

Now (also thanks to the Modernization Act) you can actually opt to receive your payments quarterly, or even annually. You can change that amount anytime, and still make up to three one-time lump sum withdrawals.

ANNUITIZATION OPTION

Another TSP option available to you is annuitization through Metlife, which provides a lifetime income to you.

On the one hand, it could provide a steady source of funds that may last longer than your actual TSP balance. However, you will also in essence be surrendering your actual TSP account balance in exchange for the annuitization. You can no longer make lump sum withdrawals from it in case of emergencies. Additionally, the annuitized income could cease whenever you pass away– regardless of how much money you actually had left in TSP. So life expectancy is a major factor to take into account here, because the annuitization is irrevocable.

REQUIRED MINIMUM DISTRIBUTION (RMD) OPTION

If you’d prefer not to access your Thrift Savings Plan except in emergencies, then you can leave it alone until you reach your RMD age.

If you’re retired, then at age 70 ½ you will be required to start taking minimum payments from your TSP. If you still haven’t retired, you’ll have to start taking out these payments once you’re older than 72.

TRANSFER/ROLLOVER OPTION

The last option available to you is to move the funds from your TSP balance into some other Individual Retirement Account (IRA) of your choice. You’ll therefore have more access to it depending on the new account you choose– but you need to take things like taxes and market volatility into consideration while doing so to make sure it’s the right place for those funds.

WHAT SORT OF CUSTOMIZED IRA COULD I GET FOR MY TSP BALANCE?

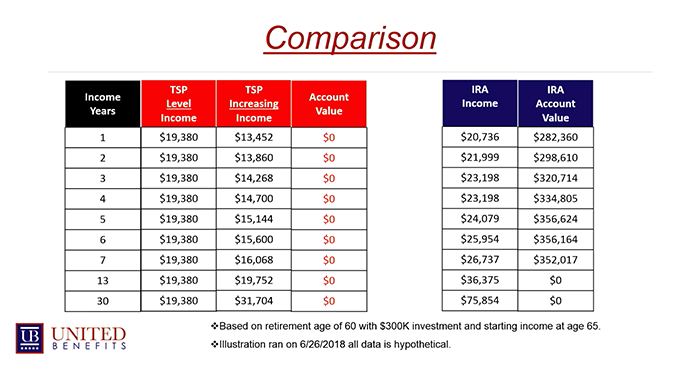

If you’re interested in a rollover, United Benefits has a number of IRA options available for federal employees. Some include level lifetime income, and some include an increasing lifetime income.

Above is a comparison of using TSP for an income stream in retirement versus rolling over your TSP into an IRA with an income option. One of the big differences here will be your account value. If you annuitize with TSP, then your account value will be zero; meaning you only have access to the predetermined income amount. But with United Benefits, your entire account value remains accessible.

Next, look at year 13 in the chart above. On the right, your account’s actual value may hit zero. But guess what? Your income will continue anyway! This all goes back to the income replacement percentage, which accounts for longevity and long-term investment risk. The account is protected and is not subject to market risk.

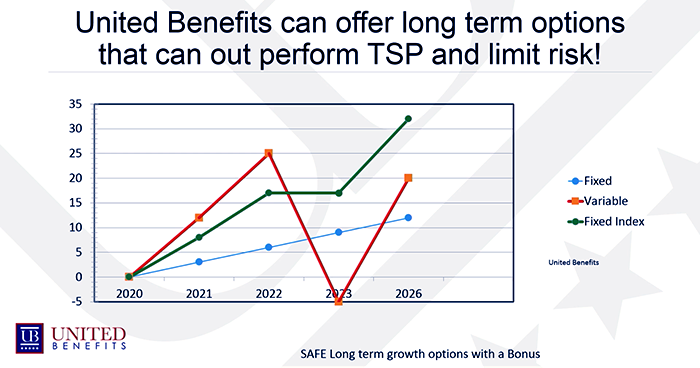

In this chart, you can see the three options available to you. You can grow with the market (red) and receive the most return, but you might also fall with the market and lose a lot of your hard-earned money.

You could opt for the fixed increasing income with TSP (blue), which is steady and safe– but it’s also capped at 3% per year. You wouldn’t necessarily receive any huge benefit from rises in the market.

An IRA with United Benefits would offer you the fixed index option (green) which rises somewhat with the market but doesn’t drop if the market does: it just flatlines wherever it last peaked. Then, when the market comes back, you begin to collect gains again. These long-term options can outperform the TSP, and limit your risk.

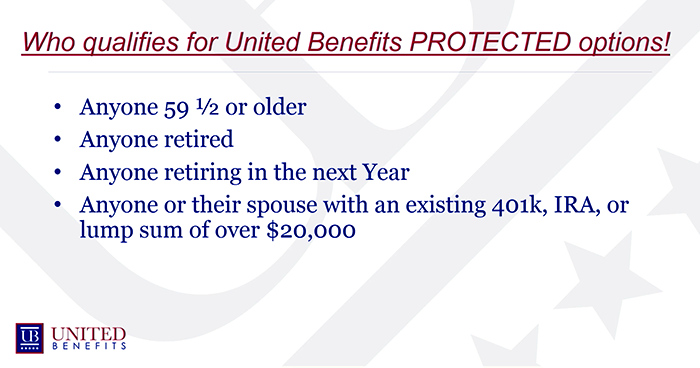

WHO QUALIFIES FOR AN IRA WITH UNITED BENEFITS?

- Anyone who’s retired

- Anyone retiring within the next year

- Anyone 59 ½ or older

- Anyone who has (or with a spouse who has) an existing 401k, IRA, or lump sum over $20,000

ARE YOU SATISFIED WITH YOUR THRIFT SAVINGS PLAN ARRANGEMENTS?

United Benefits has assisted thousands of federal employees on several impactful topics. We can help you, too. Ask us anything!

Click here to request a consultation and talk one-on-one with a representative about the options available to you.