As a federal employee, you may be wondering exactly how much money is being deducted per paycheck for your retirement. First, we need to take a look at what items are considered part of your retirement package.

Federal Employees make contributions toward (and receive) retirement benefits from four different sources:

- Medicare

- FERS, or Federal Employee Retirement System

- Social Security

- TSP, or Thrift Savings Plan

1. CONTRIBUTIONS PAID BY FEDERAL WORKERS HIRED BEFORE 2013

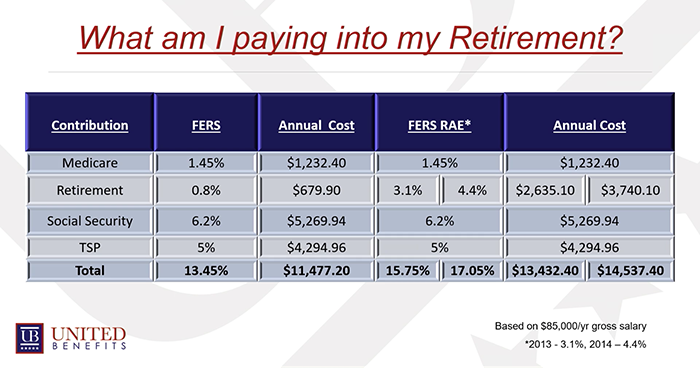

The average federal worker who’s reaching retirement age is likely contributing the following percentages of their paychecks toward retirement: 1.45% towards Medicare, .8% towards FERS, and 6.2% towards social security. That’s a total of 8.45%, after which contributions towards TSP can vary.

Let’s say you’ve also chosen to contribute 5% of your income into the Thrift Savings Plan (in order to maximize the agency matching) and your salary is $85,000 per year.

That means your annual out-of-pocket contributions to your retirement are 13.45% of your income– or $11,477.

2. CONTRIBUTIONS PAID BY FEDERAL WORKERS HIRED AFTER 2013

If you weren’t hired by the government until after 2013 or 2014, your retirement contributions will look slightly different than those hired earlier. This puts you in a category called FERS RAE (Federal Employee Retirement System Revised Annuity Employee).

If you are one of the FERS RAE, then your contributions to FERS will be either 3.1% (if you were hired in 2013) or 4.4% (if you were hired in 2014 or after). This means you may be paying anywhere from 15.75% up to 17.05% of your gross salary. Based on a $85,000 salary, that annual cost of retirement is between $13,432 up to 14,537.

3. WHY FEDERAL EMPLOYEES SHOULD KNOW HOW MUCH THEY’RE PAYING INTO RETIREMENT

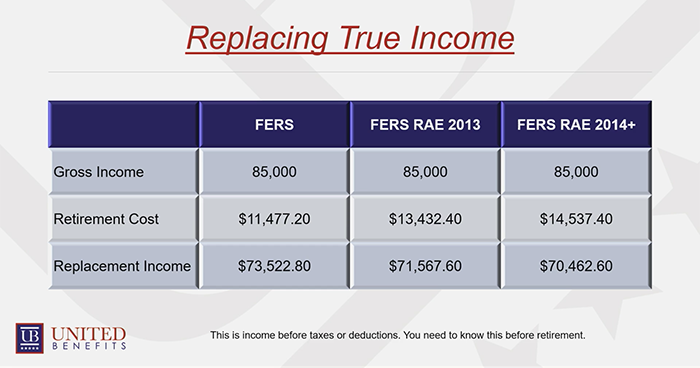

It’s important to know how much you’re contributing into retirement in order to calculate how much money you’re actually living off of in the present. Once you retire, these deductions do not occur anymore. Your retirement income doesn’t have to match your current salary in full, because you’re not currently using your salary in full.

Once you subtract your retirement contributions from your salary, that is what we call your true replacement income.

If you were hired before 2013 and your salary is $85,000, then after subtracting that 13.45% of retirement costs, your true income is $73,522.80.

Now, this $73,522.80 will still be taxable income, and your benefits (like health insurance) will also come out of this. So when you’re calculating your retirement income, it’s important to aim for your replacement income as much as possible.

That way, once you’re retired, your standard of living and current expenses will not need to be drastically altered.

ARE YOU CONFIDENT IN YOUR POST-RETIREMENT INCOME?

United Benefits has assisted thousands of federal employees on several impactful topics. We can help you, too. Ask us anything!

Click here to request a consultation and talk one-on-one with a representative about the options available to you.