Several different government agencies are covered under Special Provision Retirement, which differs slightly from the traditional Federal Employee Retirement System. In short, a number of government careers which involve more physical or mental stress are provided with options for earlier retirement.

WHICH AGENCIES RECEIVE FERS SPECIAL PROVISION RETIREMENT?

There are six agencies eligible for Special Provision Retirement through the Federal Employee Retirement System.

- Air Traffic Controllers

- Firefighters

- Law Enforcement Officers (Includes Customs & Border Protection Officers)

- Capital Police

- Supreme Court Police

- Nuclear Materials Couriers

WHEN CAN FEDERAL EMPLOYEES OF SPECIAL AGENCIES RETIRE?

If you have 25 years of service in any of these agencies, you can retire at any age. If you have at least 20 years of service, you can retire at age 50. And for some agencies, there's a mandatory retirement age at age 57 (or 56 if you’re in air traffic control). For CBPO, that started July on 6th, 2008.

* ATC mandatory retirement is at age 56

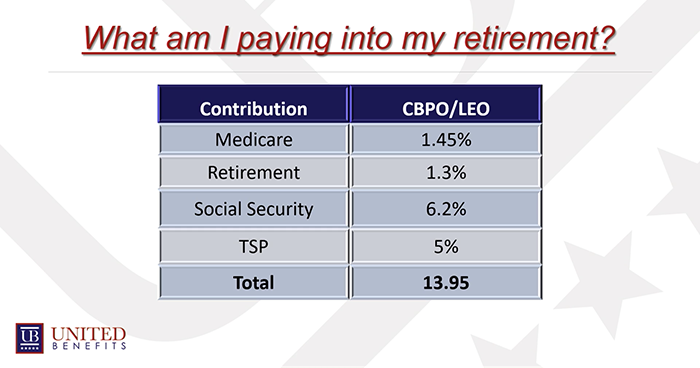

WHAT ARE MEMBERS OF THESE AGENCIES PAYING INTO THEIR SPECIAL PROVISION RETIREMENT?

Let’s say you’re a law enforcement officer. You’re putting 1.45% of your salary into Medicare, 1.3% into retirement, and 6.2% into social security. Lastly, should you choose to take advantage of the agency matching for your Thrift Savings Plan, you may also be contributing 5% to TSP.

*Hired In 2013 Retirement Contribution: 3.6% *Hired After 2014 Retirement Contribution: 4.9%

All four factors result in a total of 13.95%-17.55% of your paycheck going into your retirement.

HOW DO MEMBERS OF THESE AGENCIES COMPLETE THEIR ANNUITY FOR THEIR SPECIAL PROVISION RETIREMENT?

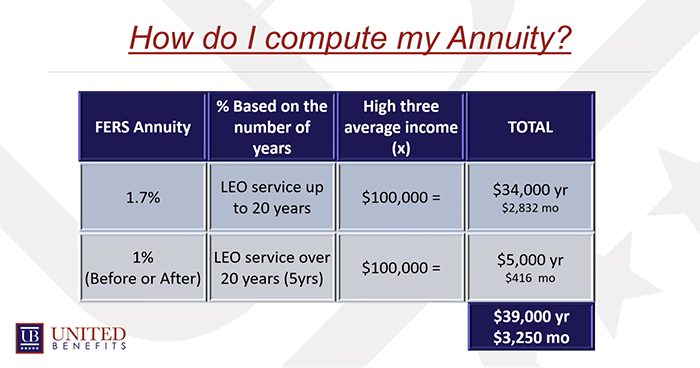

Continuing with the previous example, let’s say you’re a law enforcement officer with 25 years of service, and a high-3 average salary of $100,000. (Remember, your high-3 is the highest average salary you’ve earned during any three consecutive years of service. Usually, it’s your most recent three years.)

As you can see in this example, this will require two separate calculations. The first equation deals with your initial 20 years of LEO (Law Enforcement Officer) service; the second equation is for the next five years calculated at normal FERS.

First, multiply your first 20 years of service with your high-3 and then multiply by 1.7%. Based on this example of a $100,000 high-3 salary, the first 20 years of service for this officer would be $34,000 per year or $2,832 a month.

Next to calculate your annuity for your 21st to 25th year, multiply your total remaining years of service (in this example, 5) by your high-3 average and then multiply by 1%. In our example, that comes out to $5,000 a year, or $416 per month.

Lastly you add the totals of the two equations together, to get the total of $39,000 a year or $3,250 per month.

Many of the examples used in this blog pertain to Law Enforcement Officers. Be aware, each agency has special rules and there are many other factors to consider, including the impact on your special retirement supplement, TSP, and COLAs. It is encouraged that you reach out to a United Benefits representative to discuss your unique situation and gain a better understanding of how the Special Provision Retirement system will work for you.

ARE YOU CONFIDENT IN YOUR POST-RETIREMENT INCOME?

United Benefits has assisted thousands of federal employees on several impactful topics. We can help you, too. Ask us anything!

Click here to request a consultation and talk one-on-one with a representative about the options available to you.